additional net investment income tax 2021

Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. For estates and trusts the 2021 threshold is 13050.

Tax Changes For 2022 Kiplinger

The investment income tax is a surtax of 38 in addition to the regular income tax that certain high-income.

. Rachel Blakely-Gray Jul 15 2021. The second tax faced by high-income taxpayersthe net investment income tax NIITis a 38 percent tax on qualifying investment income such as interest dividends. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

Here are the income thresholds that might make investors subject to this additional tax. The NIIT is an additional 38 tax on investment earnings. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately. Today revenue from the net investment income tax goes to the US.

The tax will be on the lesser of these. Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the. April 28 2021 The 38 Net Investment Income Tax.

April 28 2021 The 38 Net Investment Income Tax. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or the amount that your modified. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

The investment income tax is a surtax of 38 in addition to the regular income tax that certain. Youre responsible for paying capital gains. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold.

The child tax credit for. This tax is also known as the net investment income tax NIIT. It applies to taxpayers.

The 38 Tax You May Need to Worry About. If you profit from your investments this ones for you. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year.

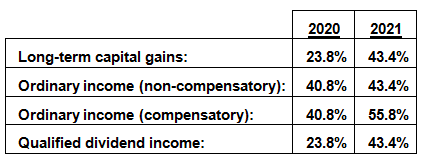

1 It applies to individuals families estates and trusts. Calculations are based on rates known as of December 21 2021. The firstthe additional Medicare taxis a.

Youll owe the 38 tax. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. When finalizing your tax projection this year dont forget about the 2021 Net Investment Income Tax NIIT liability.

Your net investment income is less than your MAGI overage. If your modified AGI is more than the threshold amount and you have net investment income youll be subject to the 38 tax.

What Is The Net Investment Income Tax And Who Has To Pay It Bankrate

2021 Tax Thresholds Hkp Seattle

How Are Dividends Taxed Overview 2021 Tax Rates Examples

2021 Tax Thresholds Hkp Seattle

What You Need To Know About Capital Gains Tax

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Net Investment Income Tax Niit Quick Guides Asena Advisors

Understanding The Net Investment Income Tax Calculation And Examples Thinkadvisor

A Crypto Review Of The Cfp Curriculum Tax Planning Part 5 Of 8 Onramp Invest

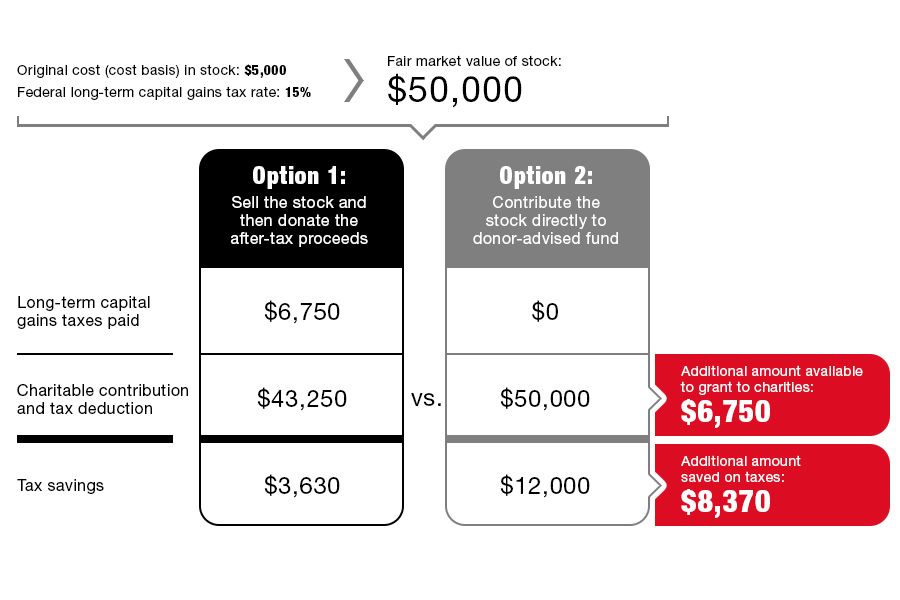

Strategies For Maximizing Clients Charitable Impact In 2021 Investmentnews

What Is The The Net Investment Income Tax Niit Forbes Advisor

How To Calculate The Net Investment Income Properly

Investment Expenses What S Tax Deductible Charles Schwab

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Net Investment Income Tax Calculator Detailed

Tax Issues And Planning To Consider Before Year End 2020 Kleinberg Kaplan